Understanding your credit card statement

Credit cards are known for being convenient. They come with a host of features and facilities. A credit card statement is issued every month to help you understand the break-up of your expenses. The statement is a comprehensive summary of your monthly transactions.

The credit card statement highlights every detail. Most of the times, the only important aspect considered is the amount due. Nonetheless, there are various other components to the credit card statement.

Here are the components that make up a credit card statement:

1. Basic Information:

It has your name, credit card number, residential address, type of credit card, and the nature of payment.

2. Statement Period:

This is the period from statement generation to the payment due. It reports the number of eligible interest-free days.

In every billing cycle of your credit card; time is allocated with no chargeable interest.

3. Due Date for Payment:

It is essential to clear the minimum payment within the stipulated due date. You are free to settle the outstanding amount before the due date. However, if you carry out the payment after this date, your bank may levy a late payment fine and interest accordingly. Depending on your due date, you should manage your payment.

4. Minimum Amount Due:

It is the minimum amount payable by you every month. It varies depending on your monthly credit card purchases. The minimum amount is a percentage of the total outstanding amount. The percentage varies from bank to bank. It is vital to pay this amount. An amount paid less than this could result in fines. It is advisable that you make a payment exceeding the minimum amount.

5. Total Due Amount:

An aggregate amount of the minimum amount due for that billing cycle, plus, any outstanding amount brought forward from the previous bill, applicable interest, late payment fees, and any pertinent supplementary charges or fines make up the total due amount. Paying the full due amount every month will prevent additional charges.

6. Transaction Particulars:

This component of the statement holds all your monthly transactions. It highlights the transaction date, amount and particulars during the billing cycle. It also highlights any cash advances and interest or fines payable.

7. Reward Points:

With every credit card comes reward points. On each spend with your card, you earn reward points. These points accumulate every month. The statement features a summary of the reward points. It is inclusive of the points at the commencement of the cycle and the points accrued during the billing cycle. It also indicates the number of points redeemed.

8. Availability of Credit Limit:

Every credit card has a stipulated limit. The available credit limit is a component of your statement. One must ensure to carry out transactions only up to the credit limit.

9. Availability of Cash Limit:

The statement underlines the monthly cash limit. Your credit card permits you to withdraw funds through an ATM. However, there is a specific limit for the withdrawal. It is a percentage of the total credit limit. Nonetheless, a cash withdrawal with your credit card will attract high charges and interest rates.

10. Statutory Information:

The most crucial component of the statement are the terms and conditions. They provide the minutest details regarding any update or rate changes.

Your statement highlights essential aspects that play a vital role in the settlement of your payment.

RBL Bank offers a wide range of credit cards suited to different people and different lifestyles. You can do everything from applying for your credit card to checking out credit card settings online, with a simple and convenient process.

Disclaimer: Articles published on the website are merely indicative and suggestive in nature and do not amount to solicitation. The contents do not guarantee the desired returns and/or results. Reader is advised to exercise discretion and consult independent advisors for achieving desired result. Visitors to this blog/ website w.r.t products & services offered by RBL Bank Limited herein, shall ensure that the comments / feedback posted shall be restricted to the contents published herein and shall not contain such language that may be un-parliamentary or against any religion, caste, section of society, political view etc. While our endeavor is to publish the comments that are submitted, however, all comments/feedback shall be subject to internal review by RBL Bank Limited. We do not guarantee that the comments that are submitted will be published.

Related Posts

Best Foods to Enjoy during Ramadan

In this blog, we will explore must-try Ramadan foods in India and the best places to enjoy them.

Mar 18, 2025

Mar 18, 2025

What are the advantages of a Digital FD?

Digital Fixed Deposits offer numerous advantages, transforming how you secure your financial future. Let's explore the key benefits of choosing digital FDs…

Mar 17, 2025

Mar 17, 2025

Digital Payments: A Smarter, Safer, and Faster Way to Transact

In this blog, we will explain digital payments, their impact, and essential safety tips for secure transactions

Mar 10, 2025

Mar 10, 2025

Deepfakes Explained: How They Work and How You Can Stay Safe

In this blog, we will explore deepfake scams, their risks, and how to stay safe from them.

Mar 05, 2025

Mar 05, 2025

FD Premature Withdrawal Penalty Calculator: Interest, Penalty & Closur..

FD premature withdrawal penalty calculator helps determine the amount you'll receive if you close your FD before the specified tenure.

Feb 18, 2025

Feb 18, 2025

Step-by-Step Guide to Updating Your Aadhaar Address Without Hassle

In this blog, we will guide you on updating your Aadhaar address online, eligibility, and required documents.

Feb 14, 2025

Feb 14, 2025

Key Takeaways from Union Budget 2025: Tax Updates and More

In this blog, we will explore Union Budget 2025's key tax changes and economic highlights.

Feb 06, 2025

Feb 06, 2025

Step-by-Step Guide to Reporting Cybercrime on India’s National Portal ..

In this blog, we will guide you on reporting cybercrimes using India’s National Cyber Crime Portal.

Feb 05, 2025

Feb 05, 2025

Step-by-Step Guide to Resolving Video KYC Photo Mismatches

Facing video KYC failures? A mismatched PAN photo may be the cause. Learn how to update your PAN card photo for smooth verification.

Jan 22, 2025

Jan 22, 2025

Credit Cards: A Guide to Maximising Your Card's Potential

Unlock the full potential of credit cards with this comprehensive guide on benefits, types, and application tips.

Jan 10, 2025

Jan 10, 2025

Mule Accounts: A Quick Guide to the Threat

Discover the dangers of mule accounts and illegal payment gateways, and learn how to protect yourself.

Jan 01, 2025

Jan 01, 2025

How to Update/Link Your Mobile Number with Aadhaar in Simple Steps

In this blog, we will guide you through linking your mobile number with Aadhaar seamlessly.

Dec 23, 2024

Dec 23, 2024

How Fradulent Android Apps are a Threat to Your Data and Finances

In this blog, we will uncover tactics of fraudulent Android apps, their warning signs, and essential protection tips.

Dec 02, 2024

Dec 02, 2024

The Rise of Digital Arrest: Safeguard Your Data from Cybercriminals

In this blog, we will explore "Digital Arrest," its risks, and practical tips to safeguard your online security.

Nov 21, 2024

Nov 21, 2024

How to Protect Yourself from Social Engineering Attacks

This blog covers how social engineering attacks work and offers essential tips to recognise and prevent them.

Nov 04, 2024

Nov 04, 2024

Shop Safely Online: Key Tips for Secure Online Shopping

This blog covers five essential tips for safe online shopping, including secure websites, safe payments, and protecting personal information.

Oct 31, 2024

Oct 31, 2024

How the India Post Delivery Scam Works and How to Avoid It

In this blog, we will uncover how the India Post delivery scam works, highlight warning signs, and share tips to help you stay secure.

Oct 29, 2024

Oct 29, 2024

Comprehensive Guide to Zero Balance Savings Accounts in India

In this blog, we will explore Zero Balance Savings Accounts, their benefits, features, and eligibility.

Oct 25, 2024

Oct 25, 2024

Shop Smart, Save Big: How to Maximise Credit Card Benefits

In this blog, we will explore how to maximize your credit card benefits and unlock savings this festive season.

Oct 10, 2024

Oct 10, 2024

Investment Fraud: How to Safeguard Your Finances

Learn how to recognize and protect yourself from investment fraud. Discover key strategies to safeguard your money and avoid common scams.

Oct 01, 2024

Oct 01, 2024

6 Tips for Effective Savings Account Management

Learn key tips to manage your savings: maximize interest, maintain MAB/QAB, monitor fees, and leverage digital banking for better financial health.

Sep 21, 2024

Sep 21, 2024

Know the eligibility criteria applicable for a Credit Card

This blog covers key eligibility criteria and required documents for obtaining a credit card, guiding you through the application process.

Sep 13, 2024

Sep 13, 2024

How to Spot and Avoid Impersonation Scams

This blog explores how impersonation scams work, highlights warning signs, and offers tips to protect yourself from these sophisticated frauds.

Sep 02, 2024

Sep 02, 2024

Shop Smarter, Save Better: Discover Shoprite Credit Card

Turn everyday shopping into rewards with the RBL Bank Shoprite Credit Card. Earn cashback, rewards points, and exclusive benefits.

Aug 23, 2024

Aug 23, 2024

Understanding Benefits of Fixed Deposits for Senior Citizens

This blog highlights the key benefits of fixed deposits (FDs) for senior citizens and why they remain a secure, reliable investment choice.

Aug 14, 2024

Aug 14, 2024

How Can You Avoid Falling into the Fraudster’s Trap

This blog covers how to protect your personal and financial information from digital fraud by identifying common scams and following key safety practices.…

Aug 05, 2024

Aug 05, 2024

Why should women have their own Savings Account?

In this blog, we explore the significance of women having personal savings accounts, promoting financial independence, literacy, and empowerment.

Jul 29, 2024

Jul 29, 2024

Credit Card EMI: Empowering Your Purchasing Power

In this blog, we explore how EMI on Credit Cards lets you convert large purchases into manageable payments, offering flexibility and budgeting.

Jul 15, 2024

Jul 15, 2024

How to Protect Your Device from APK Fraud?

In this blog, we will explore APK fraud, where cybercriminals trick users into installing malicious files to steal data and control devices. Read More...…

Jul 05, 2024

Jul 05, 2024

Tips for Identifying Genuine Bank Communications

In this blog, we will guide you on identifying genuine bank messages and tips to protect yourself from cybercrime scams.

Jul 01, 2024

Jul 01, 2024

Unlock Financial Freedom: The Perks of Zero Balance Accounts

A Zero Balance Account benefits students, young professionals, and anyone seeking streamlined banking. Here are its advantages and why it’s right for you.…

Jun 26, 2024

Jun 26, 2024

The Risks of Juice Jacking: Tips to Keep Your Data Safe

In this blog, we will explore juice jacking, a cybercrime where public USB charging ports steal sensitive information from your device. Read More....

Jun 21, 2024

Jun 21, 2024

Lost or Stolen Credit Card? Here’s Your Step-by-Step Guide

This blog covers the essential steps to take if your credit card goes missing, offering a simple and straightforward process. Read more...

Jun 10, 2024

Jun 10, 2024

How Cyber Insurance Can Save Yourself from Financial Loss

Learn how cyber insurance protects against cyber-attacks and how the RBL Bank GO Savings Account offers free coverage.

May 31, 2024

May 31, 2024

How do Credit Cards Work?

In this blog, we will explain what credit cards are, how they work, and provide tips for using them responsibly to make informed financial decisions.

May 27, 2024

May 27, 2024

10 Common Credit Score Myths You Should Know

In this blog, we'll debunk common credit score myths, providing clarity to help you make smarter financial decisions.

May 15, 2024

May 15, 2024

Parcel Scams: How to Spot and Avoid Them

This blog highlights parcel scams in online shopping, where scammers pose as delivery services to steal info or money. Stay alert.

May 06, 2024

May 06, 2024

Newly Married? Here are 5 Financial Tips to Plan your Future

In this blog, we'll explore key financial advice for newlyweds, covering joint financial planning, emergency funds, investment options, and beyond.

Apr 26, 2024

Apr 26, 2024

Step-by-Step Guide to Open RBL Bank’s GO Savings Account

Discover how RBL Bank’s GO Savings Account simplifies banking with digital ease, no balance requirement, and premium perks.

Apr 19, 2024

Apr 19, 2024

How to Spot and Avoid Dangerous Apps

Explore the dangers of apps from unauthorized sources, including malware, data breaches, and financial scams.

Apr 05, 2024

Apr 05, 2024

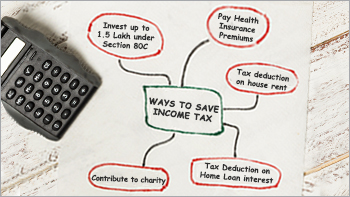

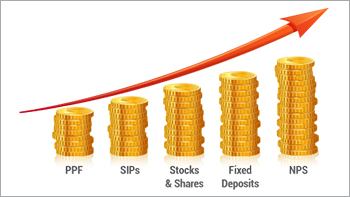

How to Save on Income Tax? A Step-By-Step Guide

In this blog, we'll explore Income Tax in India, unraveling its structure, discussing tax-saving strategies, and helping you navigate the system.

Mar 20, 2024

Mar 20, 2024

4 Ways to Save Tax with your Home Loan

Discover 4 essential ways to maximize tax savings and achieve your dream homeownership.

Mar 15, 2024

Mar 15, 2024

The Evolution of Women: From Penny Pinching to Power Planning

Celebrating women's financial empowerment, offering tailored banking solutions and resources for informed decision-making and independence.

Mar 07, 2024

Mar 07, 2024

Building the Foundation: The Power of Saving & Compounding

Saving is the process of putting money away for future use instead of spending it right away.

Mar 01, 2024

Mar 01, 2024

Financial Literacy Week 2024: Make a Right Start with Secure Online Ha..

Learn the best practices for online safety to help you navigate through the digital world with resilience and peace of mind.

Feb 29, 2024

Feb 29, 2024

How to Open a Digital Savings Account?

Opening a Digital Savings Account needs Aadhaar, PAN Card details and verification. Know these steps before opening a Digital Savings Account.

Feb 23, 2024

Feb 23, 2024

What are the types of Fixed Deposits?

Secure your future with Fixed Deposits (FDs) for guaranteed returns and flexible investment options. Learn more about different types of FDs.

Feb 09, 2024

Feb 09, 2024

How to Protect Passwords? Risks, Frauds, and Security Measures

Learn to protect your digital identity from hackers and scams with smart password choices and strong security measures.

Feb 07, 2024

Feb 07, 2024

Elevate Your Finances with RBL Bank’s GO Digital Savings!

RBL Bank's GO Digital Savings offers a zero-balance account with unlimited ATM withdrawals and a premium debit card.

Jan 25, 2024

Jan 25, 2024

How much money should you keep in your savings account?

A Savings Account offers more than saving; it’s a versatile tool with many benefits. This guide helps you navigate today’s financial landscape.

Jan 18, 2024

Jan 18, 2024

Ways to Protect Yourself Against Social Media Frauds

Beware of rising social media frauds! From phishing to identity theft, scammers exploit digital platforms. Learn to protect yourself from these scams.

Jan 03, 2024

Jan 03, 2024

8 Things You Should Consider Before Applying for an Education Loan

Education loans are a vital financial tool, supporting students globally. Here are some key benefits of education loans.

Dec 22, 2023

Dec 22, 2023

What is Net Banking? A Complete Guide

Internet banking, also known as Net Banking, isn’t just a service, it’s a financial friend that speaks the lingo of modern India.

Dec 15, 2023

Dec 15, 2023

A Complete Guide to the Home Loan Process in India

In this blog, we will explore the essential steps, benefits, and requirements of the home loan process in India.

Dec 08, 2023

Dec 08, 2023

Zero Balance, Maximum Benefits: RBL Bank’s GO Account

If you're looking for a way to save without having to worry about maintaining minimum balance, a Zero Balance Account is the way to go! Read More....

Nov 20, 2023

Nov 20, 2023

How to Safeguard yourself from Voice Cloning Fraud

Voice cloning mimics another person's voice using text-to-speech software, deep learning, and large audio datasets. Read more...

Nov 13, 2023

Nov 13, 2023

How to make the best use of Credit Cards this festive season?

Let's look at how credit cards can transform your life this festive season, from reward points to bank partnerships.

Nov 02, 2023

Nov 02, 2023

Safeguarding Your Identity: A Roadmap to Theft Prevention

Identity theft is one such threat that involves stealing individual’s personal or financial data to use their identity for fraudulent activities. Read More…

Oct 06, 2023

Oct 06, 2023

How to get a Loan Against Property? Tips & Benefits

A Loan Against Property is a type of secured loan that lets you pledge your home or commercial real estate as collateral.

Sep 30, 2023

Sep 30, 2023

Open Digital Fixed Deposit at Attractive Interest Rates

Digital Fixed Deposits allow you to earn assured returns on savings online. Some banks let you open an FD without needing a savings account.

Sep 16, 2023

Sep 16, 2023

8 Common Banking Scams and How to Prevent Them

Read on to find out the different ways in which you could get caught in the web of cybercrime, in order to stay alert at all times.

Aug 01, 2023

Aug 01, 2023

Benefits of using Credit Cards for everyday purchases

In this blog, we’ll explore some tips and strategies for you to use your credit card wisely and make the most of its benefits.

Jul 24, 2023

Jul 24, 2023

Discover the Benefits of Yoga on International Yoga Day

Here’s why should you make Yoga a part of your daily routine. This Yoga day revisit and strengthen your commitment to Yoga.

Jun 20, 2023

Jun 20, 2023

A Complete Guide and Checklist to Efficient Tax Filing

Filing your taxes on time is also important because it is a legal requirement. Here’s a checklist to follow.

Jun 09, 2023

Jun 09, 2023

Protect yourself from UPI Frauds

UPI frauds are becoming more sophisticated, so users must stay vigilant and take precautions to protect themselves.

Jun 07, 2023

Jun 07, 2023

5 ways to teach children financial responsibility

In this blog, we explore how to teach kids financial responsibility and help them develop smart money habits from an early age.

Apr 17, 2023

Apr 17, 2023

Everything to know about PAN Card fraud

This blog post provides valuable insights into PAN Card fraud, including options to check PAN Card fraud and ways to prevent falling victim to them.

Apr 03, 2023

Apr 03, 2023

Emergency Fund Guide: How to Prepare for Unexpected Expenses

Emergency fund is the ultimate solution to prevent debts from loans and overdrafts. Here are a few suggestions that can get you started.

Mar 09, 2023

Mar 09, 2023

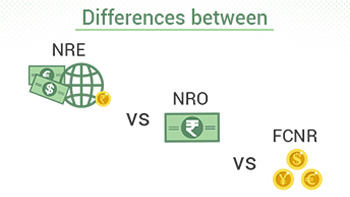

NRE vs NRO and FCNR Accounts: Know the Complete Differences

If you're an NRI looking to open a bank account in India, this article covers the three main types: NRE, NRO, and FCNR.

Feb 23, 2023

Feb 23, 2023

Everything to know about Online Frauds

Stay informed and protected with the latest insights on online frauds, from prevention to recovery tips.

Jan 31, 2023

Jan 31, 2023

A Complete Guide to ATMs: Benefits, Purpose, and Tips

ATM has truly transformed the way we manage funds online. Learn more about its features and safety tips.

Jan 13, 2023

Jan 13, 2023

What is KYC? and How important it is in Fixed Deposit

KYC (Know Your Customer) is an RBI-regulated identity verification process. Learn about its full form, types, and importance in Fixed Deposits.

Dec 30, 2022

Dec 30, 2022

Ways to get the Best FD Rates in India

Discover how to secure the best bank FD rates for maximum short-term returns. Read our blog for tips!

Dec 21, 2022

Dec 21, 2022

Best Short-Term Investment Plans with High Returns in India for 2023 ..

Short-term investment plans can enhance your savings with higher returns. Let’s explore the top six options available.

Dec 20, 2022

Dec 20, 2022

How to Choose the Right Fixed Deposits (FD) for Investment?

Learn more about the higher rates on different fixed deposit types as per your financial planning. Compare & choose which FD is best for your investment…

Dec 13, 2022

Dec 13, 2022

Understand 10 Money Saving Tips to Achieve your Goals

Here are 10 crucial money-saving tips to secure your financial future and better plan your budget.

Dec 08, 2022

Dec 08, 2022

Certificate of Deposit Vs Fixed Deposit

Discover the differences between Certificates of Deposit (CD) and Fixed Deposits (FD), including their meanings, benefits, and rates.

Dec 08, 2022

Dec 08, 2022

Difference between Savings Account and Fixed Deposit Account

Explore the differences between a savings account and a fixed deposit (FD), including their meaning, benefits, and interest rates.

Dec 07, 2022

Dec 07, 2022

Difference Between Cumulative and Non-Cumulative FD

Learn more about the difference between Cumulative Fixed Deposits (FD) vs Non-Cumulative Fixed Deposits (FD).

Dec 02, 2022

Dec 02, 2022

What is the difference between Term Deposit and Fixed Deposit?

Explore the differences between term and fixed deposits, including flexibility, interest rates, tenure, and profit potential in risk-free investments.

Nov 29, 2022

Nov 29, 2022

Bank Fixed Deposits and Corporate Fixed Deposits: Major Advantages and..

Discover the differences between Bank and Corporate Fixed Deposits to determine the best option for your needs.

Nov 29, 2022

Nov 29, 2022

Are You Overlooking These Fundamental Banking Facts? #FarzBantaHai

The #FarzBantaHai campaign educates on essential banking truths, emphasizing transparency and clear communication.

Nov 25, 2022

Nov 25, 2022

What are the types of Fixed Deposits?

Discover different types of FDs for various investment purposes to secure your financial future. Explore risk-free options.

Nov 22, 2022

Nov 22, 2022

What is a Fixed Deposit? Know the meaning & features of FD

A fixed deposit lets you invest for a set term and earn fixed returns. Learn about its definition, characteristics, and functionality.

Nov 22, 2022

Nov 22, 2022

How does a bank calculate interest on your FD?

To calculate interest on fixed deposits, use the formula (PxRxT/100) or [P * {(1+R/100) ^ T}] - P. Check out RBL Bank's FD calculator for more.

Nov 18, 2022

Nov 18, 2022

How does Fixed Deposit Account Work?

A Fixed Deposit lets you invest for a fixed term and earn maximum returns at a fixed interest rate. Learn how fixed deposits work in India.

Nov 18, 2022

Nov 18, 2022

Short-Term or Long-Term Fixed Deposit: Which One To Choose?

Explore the differences between Short Term and Long Term FDs, including definitions, benefits, eligibility, and interest rates.

Nov 07, 2022

Nov 07, 2022

Fixed Deposits vs Equity Investments – A Compressive Guide

Understand the differences between Fixed Deposits and Equity Investments, covering definitions, risks, returns, and benefits.

Nov 01, 2022

Nov 01, 2022

Fixed Deposits vs Liquid Funds: A Detailed Guide

Compare liquid funds and fixed deposits to make informed decisions, including definitions, benefits, eligibility, and interest rates.

Nov 01, 2022

Nov 01, 2022

7 Types of Bank Frauds Everyone Should Know

From mobile phones to the internet, know the different types of scams that the fraudsters run to steal your identity and your money!

Oct 28, 2022

Oct 28, 2022

Fixed Deposit vs Mutual Funds: Which is Best to Invest?

Explore the differences between Fixed Deposits and Mutual Funds, including definitions, benefits, comparisons, eligibility, and interest rates.

Oct 27, 2022

Oct 27, 2022

Fixed Deposit Vs Public Provident Fund: Which is Good?

Learn the differences between Fixed Deposits (FD) and Public Provident Fund (PPF), including their definitions, benefits, eligibility, and interest rates.…

Oct 27, 2022

Oct 27, 2022

What is the difference between a Fixed Deposit and a Recurring Deposit..

Compare fixed deposits and recurring deposits, covering definitions, benefits, eligibility, and interest rates.

Oct 20, 2022

Oct 20, 2022

Fixed Deposits: Ideal Investment Options for Beginners

New to investing? Fixed Deposits offer high returns, low risk, and easy liquidity - an ideal choice for beginners.

Oct 18, 2022

Oct 18, 2022

Digital Banking Frauds & How Can We Safeguard Ourselves?

In this blog, we will explore the rise of digital banking fraud and share effective strategies to safeguard your finances.

Sep 27, 2022

Sep 27, 2022

Get To Know Exactly What Convenience Banking Is All About!

In this blog, we will explore how convenience banking simplifies your financial activities with easy and accessible services.

Sep 07, 2022

Sep 07, 2022

What is Tokenisation and how important is it for you to use?

Tokenisation will offer an additional layer of security to users' sensitive data, preventing online and digital data breaches. Read More...

Aug 26, 2022

Aug 26, 2022

How Digital Savings Account differs from a Savings Account

Digital Savings Accounts are popular for quick, easy access and differ from traditional Savings Accounts in five key ways.

Aug 02, 2022

Aug 02, 2022

6 reasons to buy health insurance at a young age

From lesser premiums to tax benefits, here are six reasons why insurance is considered the first step in investment planning.

Jul 28, 2022

Jul 28, 2022

Vigilance - Key to avoid being a victim of online frauds

With online banking frauds on the rise, some simple precautions can help you keep your account and money secure.

Jul 05, 2022

Jul 05, 2022

4 Reasons why you need the RBL Bank Cookies Credit Card

The RBL Bank Cookies Credit Card covers all expenses, from groceries and fuel to luxury purchases and online shopping.

Jun 23, 2022

Jun 23, 2022

10 income tax rules that are effective from April 2022

Here is a quick summary of the new income tax reforms that have come into effect from April 2022.

Jun 17, 2022

Jun 17, 2022

5 Methods to Report a Lost or Stolen Debit Card

How to report a stolen or a lost debit card to the bank directly from your mobile. Read Here.

Jun 16, 2022

Jun 16, 2022

The definitive guide on salary and savings accounts

Understand the differences and similarities between a savings account and a salary account.

Jun 06, 2022

Jun 06, 2022

To #RahoCyberSafe, read some recommendations from our blog

This blog highlights some common scam methodologies and recommends a few best practices to stay vigilant in such scenarios.

May 30, 2022

May 30, 2022

How to achieve short term goals with Recurring Deposit

Recurring Deposit is one of the best products to help create a habit of saving for the future.

Apr 27, 2022

Apr 27, 2022

The many faces of Digital Banking

Learn how 'Digital Banking' is changing the lives of internet users from different walks of life.

Apr 05, 2022

Apr 05, 2022

Learn how to secure yourself from QR code scams

Let us take a look at the most common types of QR code scams and how to protect one’s savings & bank balances from such scams.

Apr 04, 2022

Apr 04, 2022

Decoding the Old and New tax regime

This blog will help you identify the right tax regime with a detailed list of exemptions, deductions, and tax rates.

Mar 09, 2022

Mar 09, 2022

How to select the perfect Savings Account #SavingsHaiAsaan

The blog highlights how to choose the right savings account, showcasing personal stories and emphasizing RBL Bank's features and benefits.

Feb 28, 2022

Feb 28, 2022

A gentle reminder on how to use the internet safely

From cyberbullying to safe mobile banking, here is a definitive guide of handling the internet safely.

Feb 17, 2022

Feb 17, 2022

Walk into the new year with a financial plan in place

As we walk into another, hopefully better year, here are 5 golden tips about financial planning to help you manage your money better.

Dec 22, 2021

Dec 22, 2021

Reasons why you should switch to Mobile Banking

RBL Bank's MoBank app ensures that all your banking needs are available right at your fingertips.

Nov 11, 2021

Nov 11, 2021

Digital Savings Account: Innovation in Convenience Banking

Looking for a reliable banking partner that lets you transact with convenience on the go? Here's what you get with RBL Bank's Digital Savings Account.

Oct 20, 2021

Oct 20, 2021

The New Normal of Convenience Banking

The evolution of the traditional savings account, and 5 ways to make your digital savings account work for you!

Oct 07, 2021

Oct 07, 2021

Tips to keep your OTP safe from online fraud

Online frauds have surged with the rise in digital transactions during the COVID-19 lockdown. It’s crucial to keep your OTP safe. Here are some tips.

Oct 04, 2021

Oct 04, 2021

Steps to take if you are victim to a credit card fraud

Let us take a look at the different kinds of credit card scams and Immediate steps to take when you have been scammed.

Sep 07, 2021

Sep 07, 2021

Tips to protect seniors from online frauds

Seniors citizens are often targeted by online scammers. Here are a few tips that will help them protect themselves from online frauds.

Aug 24, 2021

Aug 24, 2021

The millennial guide to studying abroad

Here are a few pointers that will help international students to transform outbound journey into a seamless experience.

Jul 26, 2021

Jul 26, 2021

Thank you to every Dad for being the best financial advisor

On the occasion of Father’s Day, let’s revisit some of the best financial advice given by all the Dads ever since our childhood days.

Jun 18, 2021

Jun 18, 2021

Go Green with Digital Banking this World Environment Day

Here’s a quick guide on how you can help to keep the world greener while you embrace the benefits of Digital Banking.

Jun 04, 2021

Jun 04, 2021

How Smishing works & ways to avoid it

Do you know what Smishing is and how it works? Read how to avoid getting lured by Smishing attacks.

May 17, 2021

May 17, 2021

Best Financial Gifts For Your Mother

This article seeks to shed light on viable financial gifts that can be gifted to all mothers this Mother’s Day.

May 07, 2021

May 07, 2021

A beginner’s guide to open a savings account

Let us take a look at how you can open a savings account and utilize its advantages for your good.

Apr 28, 2021

Apr 28, 2021

Sharing is not always caring, learn to #UnShare

RBL Bank's #UnShare initiative encourages caution in safeguarding your ATM PIN, CVV, OTP, and vital bank details to protect against fraud.

Apr 12, 2021

Apr 12, 2021

A Savings Account is a woman's best friend

Banks nowadays have specific ‘woman’s savings accounts’ which have been created to satisfy more benefit-hungry customers.

Mar 25, 2021

Mar 25, 2021

5 Reasons you should choose investing in FD

Looking for a reliable investment to navigate uncertain times? Here’s why fixed deposits are a smart choice.

Mar 08, 2021

Mar 08, 2021

The Do's and Don'ts of Banking for Senior Citizens

Safe banking and savings or investment options such as fixed deposits help senior citizens lead a stress-free and secure retired life.

Feb 18, 2021

Feb 18, 2021

About vaccination phishing scams and how to avoid them

Online data protection is vital amid COVID-19 vaccine phishing scams. Learn how to stay safe and avoid falling victim to these frauds.

Feb 12, 2021

Feb 12, 2021

How to choose the ideal RBL Bank Debit Card for yourself

Want to avail the ideal debit card that fits your requirements? Here’s everything you wanted to know.

Jan 26, 2021

Jan 26, 2021

Identifying a scam or a fraudster is easier than you think

Identifying a scam or a fraudster is easier than you thought. Here’s a look at how you can prevent such deceptions.

Jan 18, 2021

Jan 18, 2021

Want to pay friends and relatives immediately? Pay instantly using UPI..

This blog highlights UPI's key benefits: low cost, security, and instant transfers.

Dec 10, 2020

Dec 10, 2020

Benefits of online savings accounts

There are multiple benefits of opening an online savings account. Have a look at the benefits of online savings account.

Dec 03, 2020

Dec 03, 2020

Importance and Benefits of Tax Saving

Did you know tax planning can significantly reduce your liability? Here’s why tax saving matters and its benefits.

Nov 10, 2020

Nov 10, 2020

Festive Season Tips for Smart Shopping

As you venture into shopping during the festive season, here are a few shopping tips to keep in mind.

Nov 05, 2020

Nov 05, 2020

Stay safe when you are online

It’s important for online users to ensure cyber security to protect themselves from cyberattacks by people out to defraud.

Oct 17, 2020

Oct 17, 2020

Experience the new way of contactless banking

Get ready for uninterrupted contactless banking journey with seamless services, smart and secure features and a lot more.

Oct 13, 2020

Oct 13, 2020

Key changes in financial planning due to pandemic

The COVID-19 crisis has reshaped financial planning, requiring key adjustments to adapt to the new normal.

Sep 10, 2020

Sep 10, 2020

Smart tips for teaching children money management

It's never too early to teach kids money management. Here are some tips to get started.

Aug 21, 2020

Aug 21, 2020

How to build your credit worthiness: Millennial Edition

If you are a new millennial who wants to understand how to be a good candidate for credit, here are some tips.

Aug 19, 2020

Aug 19, 2020

How can digital finance empower more women?

Digital finance plays a key role when it comes to empowering women and ensuring greater financial inclusion.

Aug 17, 2020

Aug 17, 2020

How the internet has transformed your relationship with your bank

The advent of the internet has provided the banking sector with a digital core, which provides for reduced costs and streamlined banking services.

Aug 14, 2020

Aug 14, 2020

What is Online Phishing? How do you avoid getting your account Phished..

Let’s see what this online phishing is all about and how to prevent being their victim.

Aug 13, 2020

Aug 13, 2020

5 things to know before applying for an Education Loan

Here are some basics to keep in mind before you apply for an an Education Loan.

Aug 07, 2020

Aug 07, 2020

All about CIBIL Score and how is it calculated

If you are looking for credit, you must have heard about the CIBIL Score from a lot of people around you. Let’s find out what it is, how it works, and why…

Aug 06, 2020

Aug 06, 2020

What is the difference between CIBIL Score and CIBIL Report?

Are you new to the world of credit and confused with all the terms coming your way? Want to know the difference between CIBIL Score and CIBIL Report? Here…

Jul 30, 2020

Jul 30, 2020

Cycle Of Good Credit

The higher the score, the better are your chances of loan approval. Here’s how the cycle of credit functions in the Indian landscape.

Jul 28, 2020

Jul 28, 2020

Credit-Readiness begivns with good credit habits

A high CIBIL Score ensures easy access to credit when needed. Follow these credit habits to build and maintain good credit health.

Jul 24, 2020

Jul 24, 2020

Safety tips to prevent online banking fraud

As online banking grows, so do phishing and identity theft risks. Follow these tips for secure online banking.

Jul 23, 2020

Jul 23, 2020

Credit facts to know before getting married

A new credit card is like a new commitment—responsibilities become clear over time. Keep these three credit tips in mind.

Jul 21, 2020

Jul 21, 2020

How to plan & achieve your financial goals

The key to financial planning is to identify your goals. Next, you can chart out timelines, implement them and take stock to create a solid credit roadmap…

Jul 20, 2020

Jul 20, 2020

A quick guide to credit scores and how it impacts your loan applicatio..

A high credit score assures your lender that you have the ability to repay the loan on time, making your loan approval a smooth and easy process.

Jul 13, 2020

Jul 13, 2020

What does a 'Settled' status in your CIBIL report mean?

Most people would have a hard time understanding whether a 'settled' status on your CIBIL report is a positive or negative. Read on to understand this…

Jul 10, 2020

Jul 10, 2020

Can you bounce back from a low CIBIL score?

A low CIBIL score is not something to be dejected over. There are ways you can improve your score and gain credit.

Jul 07, 2020

Jul 07, 2020

How are Fixed Deposits different from Savings Accounts

Fixed Deposits and Savings Accounts are popular savings options. What sets them apart, and which is right for you?

Jun 24, 2020

Jun 24, 2020

What is the difference between Fixed Deposit and Recurring Deposit?

Fixed Deposits and Recurring Deposits are basic savings tools. Here's how to choose the right one for your savings.

Jun 19, 2020

Jun 19, 2020

Form 16 - What is it and how does it work?

New to the taxpayer’s club? It’s time to learn about Form 16.

Jun 16, 2020

Jun 16, 2020

Securing your data and money from cybertheft

Here are some do’s and dont’s to evade scammers.

Jun 15, 2020

Jun 15, 2020

Reasons Why You Should Opt for a Women-Specific Bank Account

Women-specific bank accounts are ideal for those opening their first account. Here's why they're a great choice.

Jun 12, 2020

Jun 12, 2020

7 foods to boost immunity

The incorporation of specific foods in the diet can strengthen the body’s immune system. Here is a look at the top 7 foods that can boost immunity.

May 16, 2020

May 16, 2020

How to make remote-teams work effectively

Remote work has become the norm post-COVID-19. Here are key measures for effective remote teamwork.

Apr 24, 2020

Apr 24, 2020

10 things for emotional well-being

We’re living in the middle of a crisis. And at times like these, your emotional well-being is as important as your physical health.

Apr 22, 2020

Apr 22, 2020

How to make fitness affordable using digital apps

While gyms and parks remain closed due to COVID-19, here’s how health apps make fitness more affordable than ever.

Apr 21, 2020

Apr 21, 2020

Threat of Financial Scams under Covid-19

Fraudsters are exploiting the COVID-19 situation through tactics like Phishing, Vishing, and Smishing.

Mar 31, 2020

Mar 31, 2020

What is semi-retirement and why is it a growing trend?

Many are choosing to work post-retirement, a trend called semi-retirement. Here's why it's on the rise.

Mar 02, 2020

Mar 02, 2020

How millennials save differently from their parents

Millennials are the generation that’s most comfortable with going online and transacting, booking shows and ordering cabs on their smart devices.

Mar 02, 2020

Mar 02, 2020

Planning to save taxes: Watch out for these pitfalls

With tax season in full swing, taxpayers are seeking ways to reduce liability. Here are key pitfalls to avoid.

Mar 02, 2020

Mar 02, 2020

The work from home experiment: A history of hits and misses

In this blog, we explore the benefits and challenges of remote work enabled by digital advancements.

Mar 02, 2020

Mar 02, 2020

Want to save income tax? Here are some ways to do it

With the financial year-end approaching, taxpayers wonder: 'How can I save on income tax?' Here are some tips for saving tax in India.

Feb 12, 2020

Feb 12, 2020

5 things you need to know about tax saving fixed deposits

Considering Tax-Saving FDs? Before you invest, here are 5 essential facts you should know.

Feb 12, 2020

Feb 12, 2020

Have you got a salary increment? 5 ways to invest your money

Got a salary hike? Congratulations! While celebrating your increment, consider these smart investment strategies to make the most of your increased earnings…

Feb 12, 2020

Feb 12, 2020

What is Section 80C? All you need to know!

Planning for the next financial year? Section 80C offers great investment options to save on income tax.

Feb 07, 2020

Feb 07, 2020

Things to Note Before Applying for a Credit Card

If you’re decided on owning a credit card and are applying for one, here are some essential points to consider.

Dec 30, 2019

Dec 30, 2019

Five ways to get started on your savings journey

As you start earning, future goals may seem distant, but saving early is a smart habit. Here are 5 ways to kickstart your savings journey.

Dec 30, 2019

Dec 30, 2019

Basic banking processes you can teach your kids

For children to imbibe financial discipline, essential for addressing life goals, it’s important for them to be familiar with the basic banking exercises.…

Dec 28, 2019

Dec 28, 2019

5 hot new cuisines you should consider exploring

It is often said that the best way to experience a culture and a country is by experiencing its food. Here are some hot new cuisines you should consider…

Dec 17, 2019

Dec 17, 2019

How to reset your PIN online

A PIN is the easiest way to keep your account safe. It’s good practice to keep changing it frequently. Here’s how to reset it.

Dec 11, 2019

Dec 11, 2019

How to redeem Credit Card reward points

Credit Card reward points can be redeemed for different products and services. Here is how to go about it.

Dec 11, 2019

Dec 11, 2019

Eating out & Credit Card

RBL Bank’s range of Credit Cards will ensure that you embrace the foodie in you. Let’s look at some of the food options available.

Dec 11, 2019

Dec 11, 2019

Things to Know Before Swiping Your Credit Card at an ATM

Here are some important things to know before you use your Credit Card at an ATM.

Dec 11, 2019

Dec 11, 2019

Have a Credit Card? Here’s why you need another

In this blog, we will explore how multiple credit cards can improve rewards, credit scores, and management.

Dec 11, 2019

Dec 11, 2019

5 advantages of using your Credit Card internationally

Credit cards are useful for international travel, enabling cash-free payments. Here’s a look at additional benefits.

Dec 11, 2019

Dec 11, 2019

How to build your credit score while swiping your Credit Card

Did you know a good credit score helps you access loans and credit products? Let’s discuss what a credit score is and how to improve yours.

Dec 11, 2019

Dec 11, 2019

Tap into the financialization of Indian savings without hassle

The trend of financialization of Indian household savings is largely being driven by the surge in mutual fund inflows.

Dec 02, 2019

Dec 02, 2019

Save money on your foreign trips with International Debit Card

To plan a trip abroad, you can simply use your existing debit card to save money and explore without any worries.

Dec 02, 2019

Dec 02, 2019

What is a Digital Savings Account & who should opt for it?

A Digital Savings Account lets you open and operate it anywhere using your Aadhaar and PAN.

Dec 02, 2019

Dec 02, 2019

Best ways to carry foreign currency while travelling abroad

We have outlined the best ways available to you to carry foreign currency for a travel abroad, whether for business or a vacation.

Nov 26, 2019

Nov 26, 2019

Ways to keep your Credit Card safe while shopping online

With the onslaught of online shopping and transactions, your credit card could be vulnerable to hackers who have been getting smarter by the day.

Nov 26, 2019

Nov 26, 2019

Ways to Protect Yourself from Credit Card Frauds

In this blog, we’ll share simple steps to protect your credit card as fraud cases rise with increasing usage.

Nov 26, 2019

Nov 26, 2019

How to plan for a stress-free retirement

In this blog, we’ll explore how focused and careful planning can help you achieve a stress-free and enjoyable retirement.

Nov 26, 2019

Nov 26, 2019

How to inculcate a habit of saving in children

In this blog, we’ll discuss key ways to instill saving habits in children for better financial discipline in the future.

Nov 26, 2019

Nov 26, 2019

7 ways Mobile Banking spells convenience

Mobile banking enables financial transactions on smartphones or tablets. It's convenient, accessible, and eco-friendly.

Nov 26, 2019

Nov 26, 2019

What is a Credit Score & why is it important?

A credit score is a three-digit number assigned by a Credit Information Companies (CIC) to a borrower based on his or her track record WRT earlier and…

Nov 26, 2019

Nov 26, 2019

Essential tips for Safe Banking

In the digital age when most banking activities are done online, it’s essential to be even more cautious. Here are some key tips for safe banking.

Nov 26, 2019

Nov 26, 2019

How Mobile Banking is transforming traditional banking

Mobile banking's rise is driven by Digital India policies, better connectivity, and its inherent benefits.

Nov 26, 2019

Nov 26, 2019

5 point checklist while going abroad

Following these small steps before your trip will help you maximize your enjoyment and minimize any worries!

Nov 26, 2019

Nov 26, 2019

The rise of Credit Cards in India

In this blog, we explore how credit cards can help Indians optimize budgets while providing the freedom to spend wisely.

Nov 26, 2019

Nov 26, 2019

Fostering women entrepreneurship in rural India through financial incl..

The empowerment of women is essential for achieving the objective of inclusive, equitable and sustainable development and economic growth in any nation.

Nov 26, 2019

Nov 26, 2019

Benefits of owning multiple credit cards

Multiple cards give you access to a large amount of credit. It helps you make the most of the interest-free period. When used wisely, having more than one…

Nov 26, 2019

Nov 26, 2019

Tips for buying Health Insurance

With rising healthcare costs and medical inflation, health insurance is essential. Consider these factors before purchasing a policy.

…

Nov 26, 2019

Nov 26, 2019

Personal Banking

Personal Banking  Corporate Banking

Corporate Banking  Prepaid Cards

Prepaid Cards  Credit Cards

Credit Cards Debit Cards

Debit Cards